2017 Upate: Link here for the current VT Homestead Forms

YAWN. You must think I’m crazy, sitting here expecting you to listen to me talk taxes. I know, you can’t think of anything more boring. Trust me. I’m with you on this one. 500 words or less. Give me a chance, hang in with me here.

Form HS-122 – Section A

For residents of Vermont, the Department of Taxes has messed with us good on this one. First it was to be filed yearly. Then it became file it once until your circumstances change. Back to filing yearly. Make up your mind, which is it??? Well, it’s yearly now, love it or leave it. The good news is – the form takes but a second to file. Even I could file it, but I know better to stay out of that part of my life and I leave it either to my wife or our accountant.

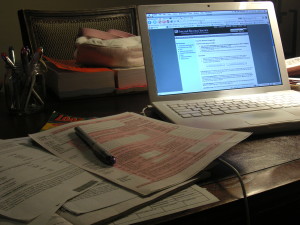

You can do it online, no fee for the service. You can also download a fillable PDF copy here: 2014HS-122. Really, you can do this, but you will need a copy of your tax bill in front of you.

When do you have to do this? BY APRIL 15th. And this is key: you need to do it by April 15th whether or not you’re filing an extension for your taxes. Section A has nothing to do with your income, Section B does, but if you follow the instructions – you’ll see a place where you can check that you will be filing a Property Tax Adjustment claim later (as in, you’re filing an extension).

Go now, fill out the form and send if off. Because if it’s late, the legislature in all their wisdom has allowed your local Government to charge a penalty on the school tax portion of your bill – and depending on how the local tax rate falls (which tax rate is higher – residential or nonresidential) that fee could possibly be as high as 8%. Ouch!

So go. File it and forget it.

333 words. OK 337 339 now.

Recently Sold

Recently Sold