Overall 2015 was a very good year in the Mad River Valley Real Estate Market. Volume was up, prices were up and winter finally appeared at Sugarbush and Mad River Glen, following an extended hiatus. Yet numerous people still approach me and ask “how’s the market” and the expression on their face betrays the unease they clearly feel. I suppose it is natural to be skeptical, considering that the most tumultuous financial disaster in our nation’s history still remains vivid in our memories, and that disaster badly damaged much of the perceived equity many had staked in their homes. We still feel the after-effects, and will continue to feel them for many years to come. It’s difficult to feel entirely whole, even some time on.

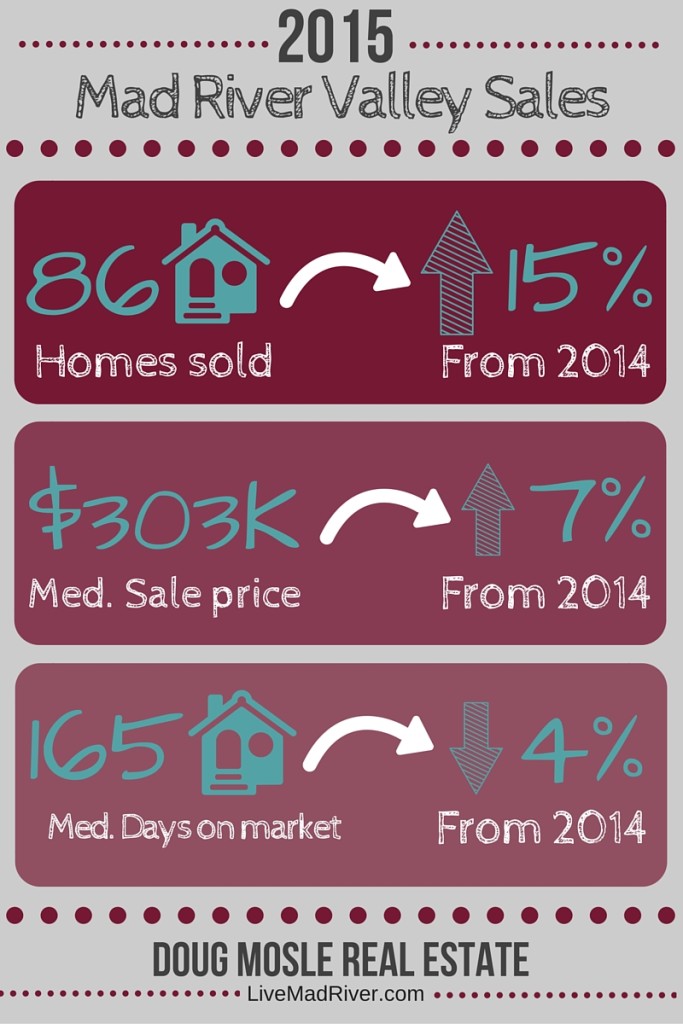

So I perform a healthy exercise when an imbalance appears between perception and my day-to-day observations in this market. To counter that inevitable skepticism, I went to the numbers and found some reassuring data that should make even the heartiest skeptics feel better. In fact there were 86 residential sales in 2015 which represents a 15% increase in sales volume over fiscal year 2014, which had been the previous high-water mark since the crash. Furthermore, the median home sale price increased from $284,500 in 2014 to $303,325 in 2015 – an increase of nearly 7%. More importantly this is the first time median sales of homes in the Mad River Valley have topped the $300,000 mark since 2008, when the median reached a pinnacle of $325,000. The 86 residential home sales represented the highest volume of sales since 2004, which was arguably at the height of the bubble and a far cry from the the abyss of 2009, when sales volume lurched to a halt and the median fell to $225,000. In other words, residential sales in 2015 were the strongest we have seen in 10 years, and that’s saying something.

Safe Haven Since more than 60% of the homes here in the Mad River Valley are purchased and maintained by second home buyers, it means that real estate fortunes here are significantly impacted by forces outside our control – most notably the financial markets at home and abroad. Traditionally Bull markets on Wall Street do not portend strong real estate sales, as real estate has historically been the “safe haven” for investors when markets show volatility. When Bull markets lead into classic Bear markets, as they have during the first 3 weeks of 2016, a seasoned investor might see opportunity. During such sell-offs, investors traditionally run towards real estate in search of security, especially following a time of prosperity, however brief. So, as median sales increased steadily in 2015, and sales volume for the year returned to pre-2006 levels, we have seen the first significant drop in residential inventory since 2006 – and since real estate is the classic supply and demand industry, there is a real possibility for the perfect real estate storm in 2016. Lower inventory, 3 consecutive years of growth, a sustained time of financial prosperity in the markets in 2015 and now, volatility in the markets at home and abroad. 2016 should be a whopper of a year for sellers and investors alike.

Long Strange Trip While the news in the residential market is quite good, the condo market is a little fuzzier. We have seen three relatively strong years of sales volume from 2013-2015, but still a far cry from the peak from 2002-2005, when the market shed 404 units in four years. In the meantime, median prices have consistently fallen to a 5-year LOW since 2010, while maintenance cost increases and the inefficiencies of 1970’s construction fall under greater scrutiny. The net result has been a sea change for investors from older, poorly maintained condos and towards cost-controllable residential properties and newer or better maintained condos, such as those being constructed at Sugarbush. Inventory in the condo market remains high, so the concept of value here remains with the investor who is willing to scoop up relatively cheap rental properties and weather the inevitable assessments that befall older condo complexes, where long term deferred maintenance is beginning to show up in association budgets.

Under All Is The Land Finally, the land picture has not really improved, but there is definitely hope on the horizon. Analyzing sales data going back to the beginning of the bubble, the picture is pretty clear and the path forward even clearer. Land sales in the Mad River Valley peaked from 2000-2006 – a period where 288 parcels sold, and where the median climbed from $7500/acre to $35,000/acre. At the same time, residential homes sales were were beginning their historic climb, topping out in 2008 at a median of $325,000.

It may come as no shock that the decline in land sales began in 2005 when the median topped $30,000/acre, while residential sales that had peaked between 2004-2006 were already trending downward. With housing inventory burgeoning, and prices on the decline, you need not be an economist to understand what was happening; few people buy when prices are dropping, it’s just contrary to human nature. And as the housing market slowed, land prices carried momentum upwards to a median of $35,000 per acre in 2007, even as volume was dramatically off. It looked like a hiccup at the time, but as we now understand the fall had begun..

As the median price of a home hit the skids in 2009, land sales slowed but prices remained high, signaling the start of a 6-year trend where affordability of available land was out of proportion with the affordability of the homes on the market. In other words, it became far cheaper to buy a home and fix it up than to buy land and build. And while the market for land has steadily improved, with volume up and median price per acre down, the market for land awaits one final boost from the housing sector. As home sale volume increases, and inventory drops we should see a natural arc in median sales, and as that number approached $325,000 again land should follow that historical trend.

In 2015 we look at the median sale price of residential homes hitting 303,325 and the familiar pattern becomes clear. As the median home sale price has increased steadily over the past three years, so too have land sales from a low in 2009 to a 10-year high in 2015. If we learn anything from history, we already see the bright light at the end of the tunnel; 2016 looks like a terrific time to buy or sell land.

There are inevitable bumps in the data. We are a small community and small sample sizes can be misleading. There are inexplicable imbalances that can not be answered with data alone and there are obvious trends now that were imperceptible when they started. But the beauty of the data is that it tells a story, and the story becomes our history. And history tells us that even while the financial markets around us paint a grim picture today, the health of the housing market seems ready to weather that storm, and provide the shelter for investors feeling the burden on their portfolios. The market is on the move, even if caution is the catch word of the day. 2015 was a good one. 2016 should see the market land back on solid ground.

Recently Sold

Recently Sold