Lovely and private 4+ BR home in the heart of the Mad River Valley. Open concept living, located minutes from town and skiing with views out your

Trail Side II Unit #36 (3D video tour)

Outstanding ski-in location. World class skiing right out your front door. Excellent opportunity for an established income producing property right on

125 Carlyle Road – OPEN HOUSE

Sunday July 26, 1 - 3 pm

111 Pine Tree Lane, Fayston VT

Exceptional craftsmanship and quality are only the start in this custom-built 3BR/3BA Colonial. The stunning property features 9' ceilings, plastered

125 Carlyle Road, Warren VT

Really nice, well maintained cape in an exceptional location, a few minutes from world class skiing at Sugarbush and Mad River

Snowside #10, Fayston VT

Spacious, bright and modern, this exceptional 2- bedroom condo sits in one of the best locations at Sugarbush; amazing views, minutes from the ski

Buying a home

Buying a home can be a stressful process but it does not have to be, and in most cases the stress is directly proportional to the quality of the

Drumleys #17, Warren VT

SOLD! Spacious, bright and modern, this multi-level three bedroom condo sits in one of the best locations at Sugarbush; minutes from the ski trails,

North Lynx #65, Warren VT

UNDER CONTRACT. Excellent launching pad for your Mad River Valley, Sugarbush, Mad River Glen and Central Vermont adventures. World class skiing a

South Village #19, Warren VT

SOLD. The Villas at South Village. Outstanding 3BR/3BA unit in the lower phase at South Village. Close to the ski area but tucked away in the quietest

Sterling Ridge #2, Warren VT

SOLD. Immaculate 2BR/3BA condo, minutes away from world class skiing at Sugarbush Resort and Mad River Glen. Exceptional location on the Mountain

Pine Tree Lane, Fayston VT

SOLD! Exceptional craftsmanship in this custom built 3 bedroom Appalachian style log home. Constructed from 98 hand-picked northern Vermont softwoods,

Understanding the language of real estate – what did that Realtor just say to me?

Real estate agents (we call them licensees, for reasons that will become clear later on) licensed in the State of Vermont are required to take 24

Shady Tree Lane, Fayston VT

SOLD! Outstanding 3+ bedroom, Eberle designed New England Saltbox, located at the end of the road in the popular Hiddenwood neighborhood. The

Wild Turkey Lane, Fayston VT

SOLD! Outstanding hilltop property constructed in 2001. This extraordinary custom home is perched on 6.8 private acres with views of Sugarbush Ski

Harris Hill Road, Fayston VT

SOLD! Extraordinary quality at every turn in this custom designed and elegantly constructed replica of a German Barn. Exquisite trim work, stained

Snow Creek #52, Warren VT

SOLD! Updated and stylish Snow Creek condo on the ski slopes at Sugarbush Resort's Lincoln Peak. Completely renovated open kitchen with soapstone

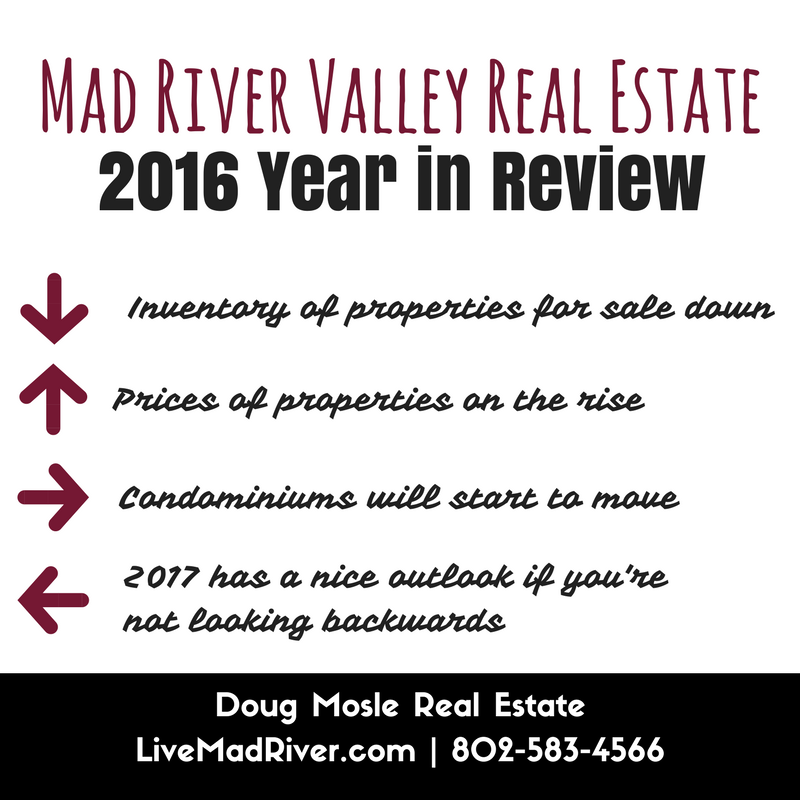

Mad River Valley Real Estate – 2016 Year In Review

As 2016 approached an end, it seemed like just about everyone I knew was happy to kiss this one good bye. We came off an awful 2015/16 ski season, the

Recently Sold

Recently Sold